Examine This Report about Hard Money Georgia

Wiki Article

Hard Money Georgia - Truths

Table of ContentsThe 10-Minute Rule for Hard Money GeorgiaHow Hard Money Georgia can Save You Time, Stress, and Money.Hard Money Georgia Can Be Fun For AnyoneSome Ideas on Hard Money Georgia You Should KnowUnknown Facts About Hard Money GeorgiaThe smart Trick of Hard Money Georgia That Nobody is Talking About

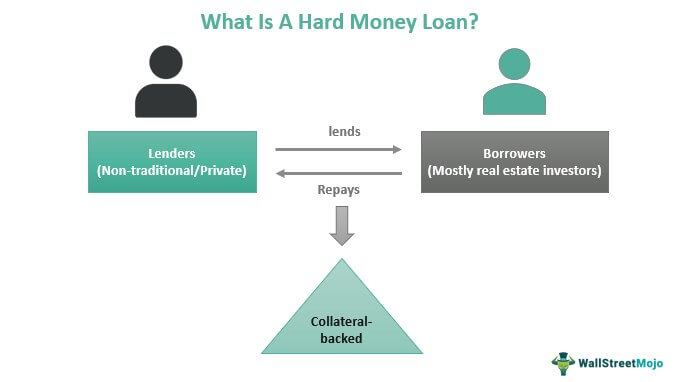

A hard cash loan is a customized funding device that is usually used by professional investor. Professional real estate financiers know the ins and also outs of difficult money fundings, yet less seasoned financiers need to inform themselves on the subject so they can make the most effective decision for their details job.In a lot of cases the approval for the difficult cash financing can occur in just one day. The tough money lending institution is mosting likely to take into consideration the residential property, the quantity of down repayment or equity the consumer will certainly have in the residential or commercial property, the borrower's experience (if applicable), the exit method for the building and also make certain the borrower has some cash money gets in order to make the month-to-month finance repayments.

Investor that have not formerly used tough cash will be surprised at how swiftly tough cash car loans are moneyed compared to banks. Compare that with 30+ days it takes for a financial institution to fund. This quick financing has saved many actual estate capitalists who have actually been in escrow only to have their original lending institution draw out or just not provide.

All About Hard Money Georgia

Their checklist of requirements boosts every year and also many of them seem approximate. Banks additionally have a checklist of problems that will certainly raise a warning and also avoid them from also taking into consideration providing to a consumer such as recent foreclosures, short sales, financing modifications, and also bankruptcies. Poor credit scores is another factor that will protect against a bank from providing to a debtor.Luckily for real estate financiers that may currently have several of these issues on their document, difficult cash lending institutions are still able to lend to them. The hard money lending institutions can provide to consumers with issues as long as the customer has enough down payment or equity (at the very least 25-30%) in the home.

In the case of a potential consumer that wishes to acquire a main residence with an owner-occupied difficult cash funding with an exclusive mortgage loan provider, the debtor can at first acquire a home with hard cash and afterwards work to fix any kind of issues or wait the required quantity of time to clear the concerns.

10 Easy Facts About Hard Money Georgia Explained

Financial institutions are additionally unwilling to supply home mortgage to customers that are freelance or presently do not have the needed 2 years of work history at their existing position. The consumers might be a suitable candidate for the car loan in every other aspect, but these approximate needs protect against banks from expanding funding to the debtors (hard money georgia).In the situation of the consumer without sufficient work history, they would certainly have the ability to refinance out of the difficult money funding as well as right into a reduced expense standard loan once they obtained the essential 2 years at their existing setting. Hard cash lenders offer many fundings that conventional lending institutions such as financial institutions have no passion in financing.

These jobs entail a genuine estate investor purchasing a property with a short-term funding so that the capitalist can rapidly make the required repairs as well as updates and afterwards sell the residential property. Most of the times, the real estate investor only requires a 12 month loan. Banks desire to offer money for the long term as well as are satisfied to make a percentage of passion over a lengthy period of time.

Not known Facts About Hard Money Georgia

The concerns could be connected to foundation, electric or plumbing as well as might trigger the bank to think about the residential or commercial property unliveable as well as not able to be funded. and also are unable to think about a funding situation that is outside of their rigorous lending standards. A hard money loan provider would be able to offer a debtor with a financing to buy a home that has concerns stopping it from receiving a traditional bank lending.web link

While the rate, low requirements and flexibility of difficult cash finances guarantees investor have the funding they require to finish their projects, there are some aspects of difficult cash loans that can be considered less than suitable. Difficult money financing rate of interest prices are always mosting likely to be greater than a conventional bank financing.

Tough cash loan providers also charge a financing source charge which are called points, a percent of the loan amount. Factors usually vary from 2-4 although there are loan providers that will bill much higher points for specific scenarios. Particular locations of the nation have numerous contending tough money loan providers while various other locations have couple of.

All about Hard Money Georgia

In huge cosmopolitan locations there are generally much more hard cash lenders ready to offer than in farther backwoods. Borrowers can profit significantly from checking rates at a few different loan providers before devoting to a tough cash lending institution. While not all difficult cash lenders use 2nd home mortgages or depend on actions on properties, the ones that do bill a higher rate go to the website of interest on 2nds than on 1sts. hard money georgia.

If right here rate of interest drop, the customer has the alternative of refinancing to the reduced current prices. If the rate of interest prices increase, the consumer is able to maintain their reduced rate of interest funding as well as loan provider is forced to wait up until the loan ends up being due. While the lender is awaiting the loan to come to be due, their investment in the trust act is yielding less than what they might get for a brand-new trust deed investment at present prices. hard money georgia.

The 5-Minute Rule for Hard Money Georgia

Banks handle passion rate uncertainty by supplying lower interest rates for much shorter terms and higher passion rates for longer terms. As an example, a three decades totally amortized car loan is mosting likely to have a much higher passion rate than the 15 year completely amortized finance. Some borrowers see down settlements or equity demands as a detriment that stops them from getting a car loan.Report this wiki page